Welcome to

FinanceKey Demo

Save money, free-up your time and innovate faster using FinanceKey. Take advantage of real-time corporate banking in an easy, intelligent and secure way.

Ready to start?

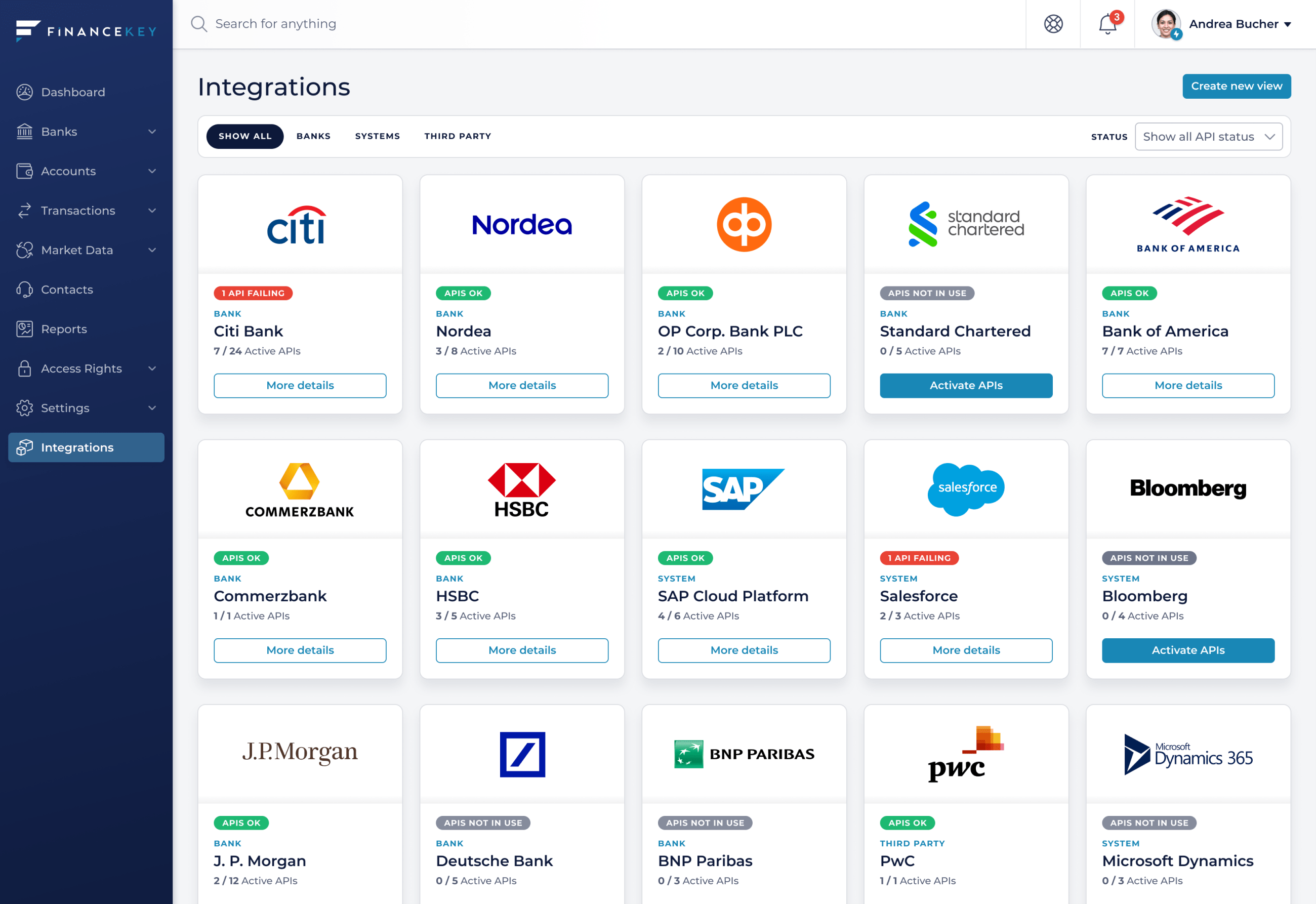

Start by integrating company email with FinanceKey, to enable Single Sign-On.

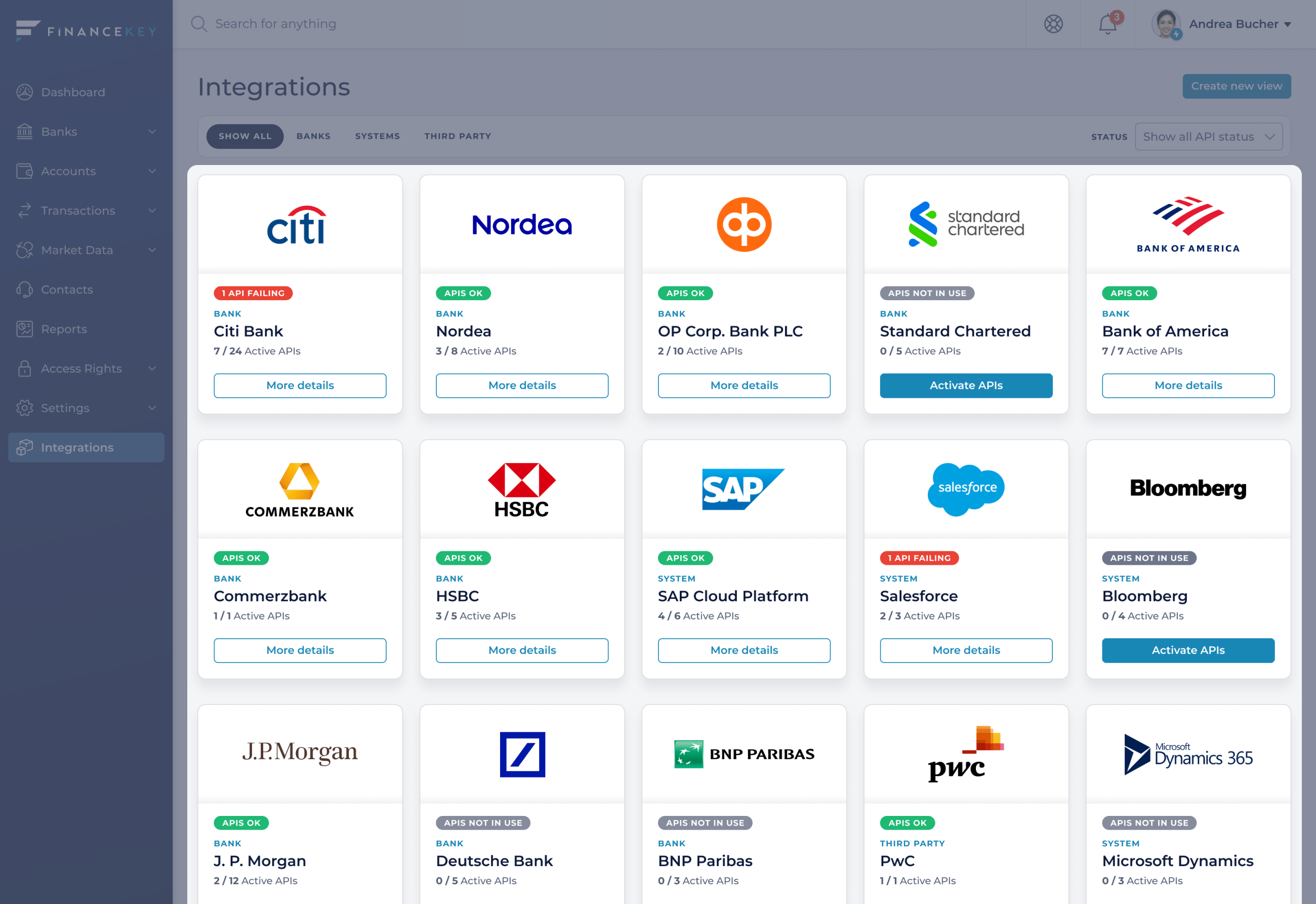

Next, choose the banks to connect to and the bank-specific APIs. For testing purposes, we can set up connections to the testing environments of your relationship banks.

With bank API agreements in place, you'll get to experience easy, intelligent, and seamless corporate banking from day 1.

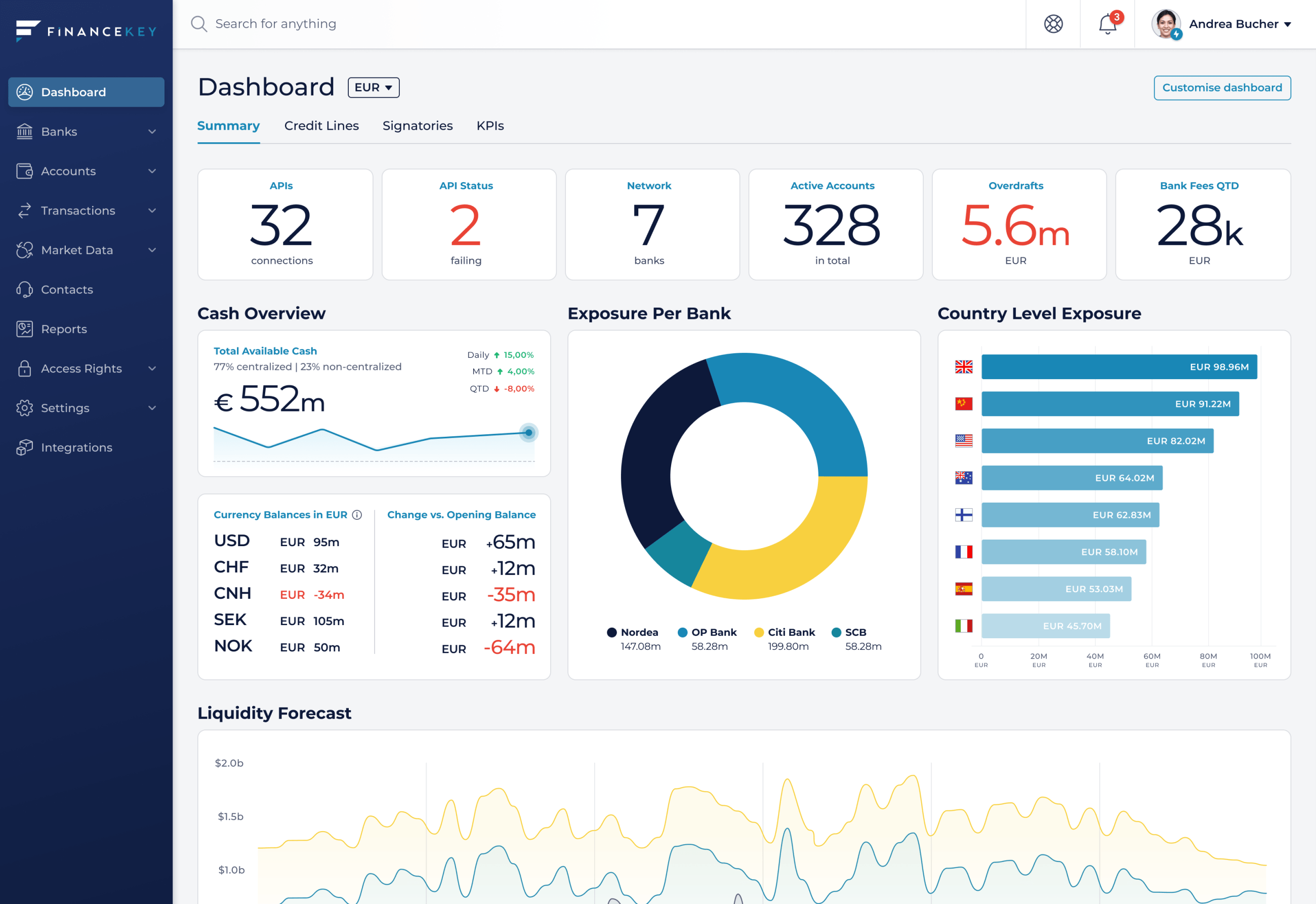

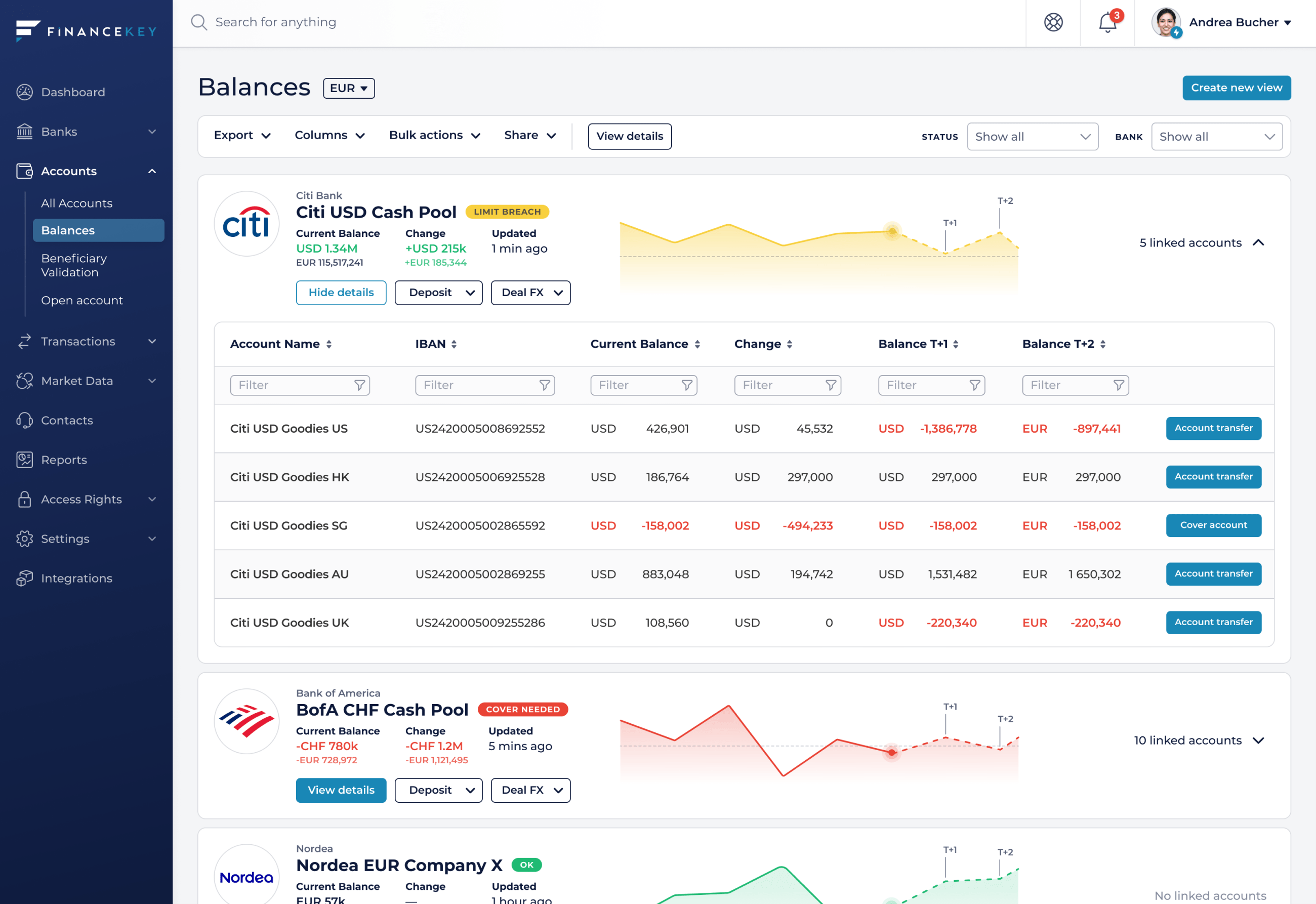

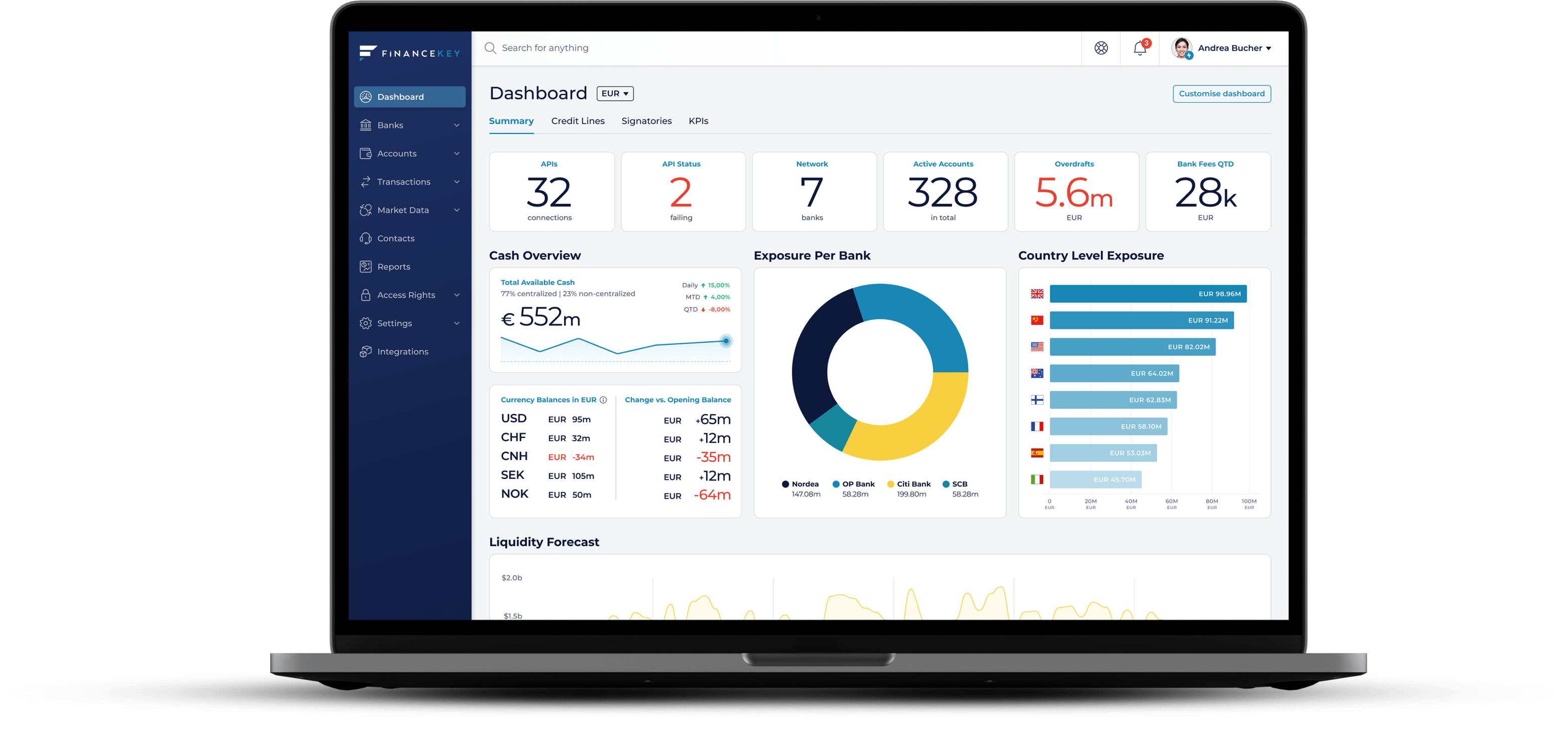

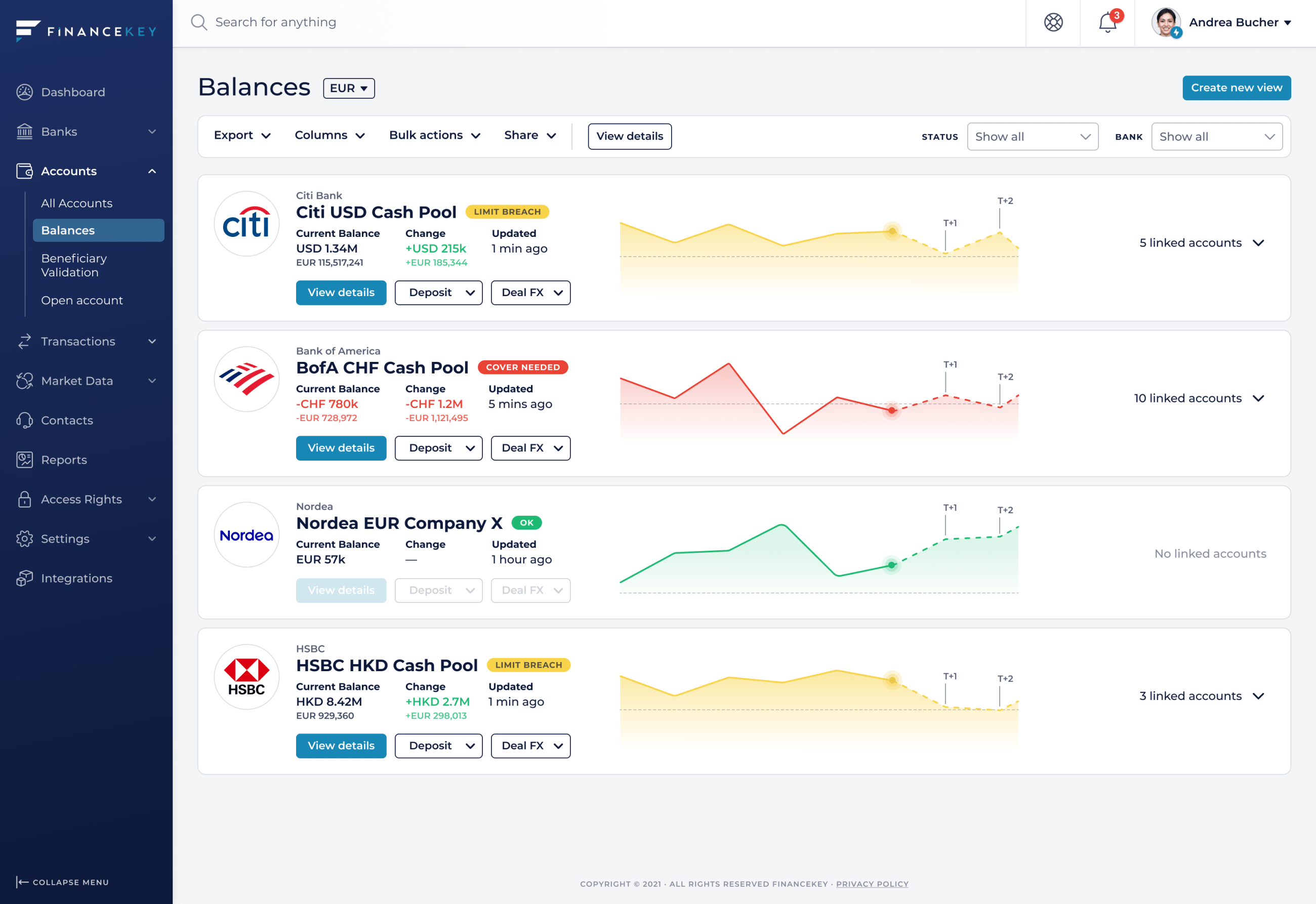

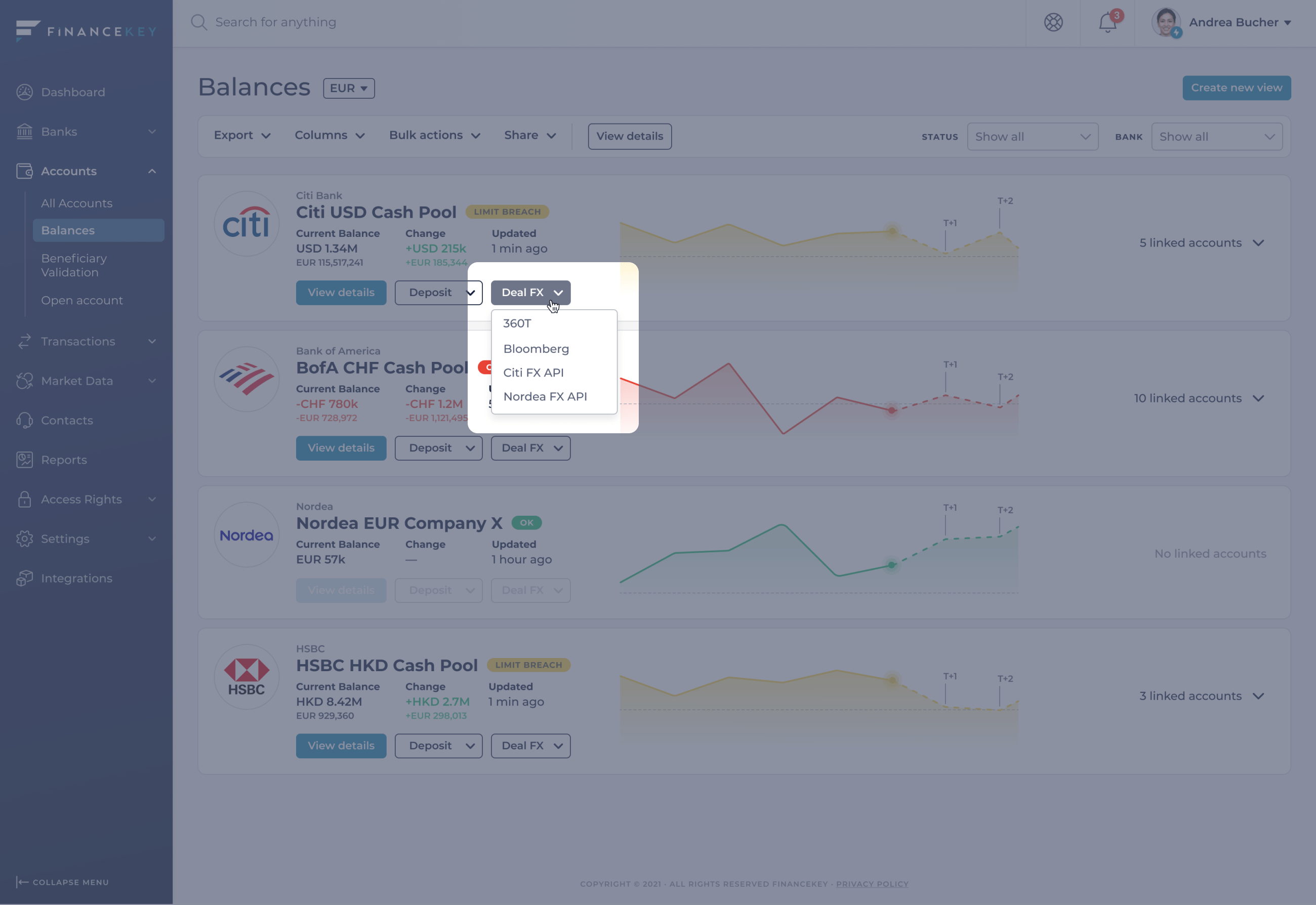

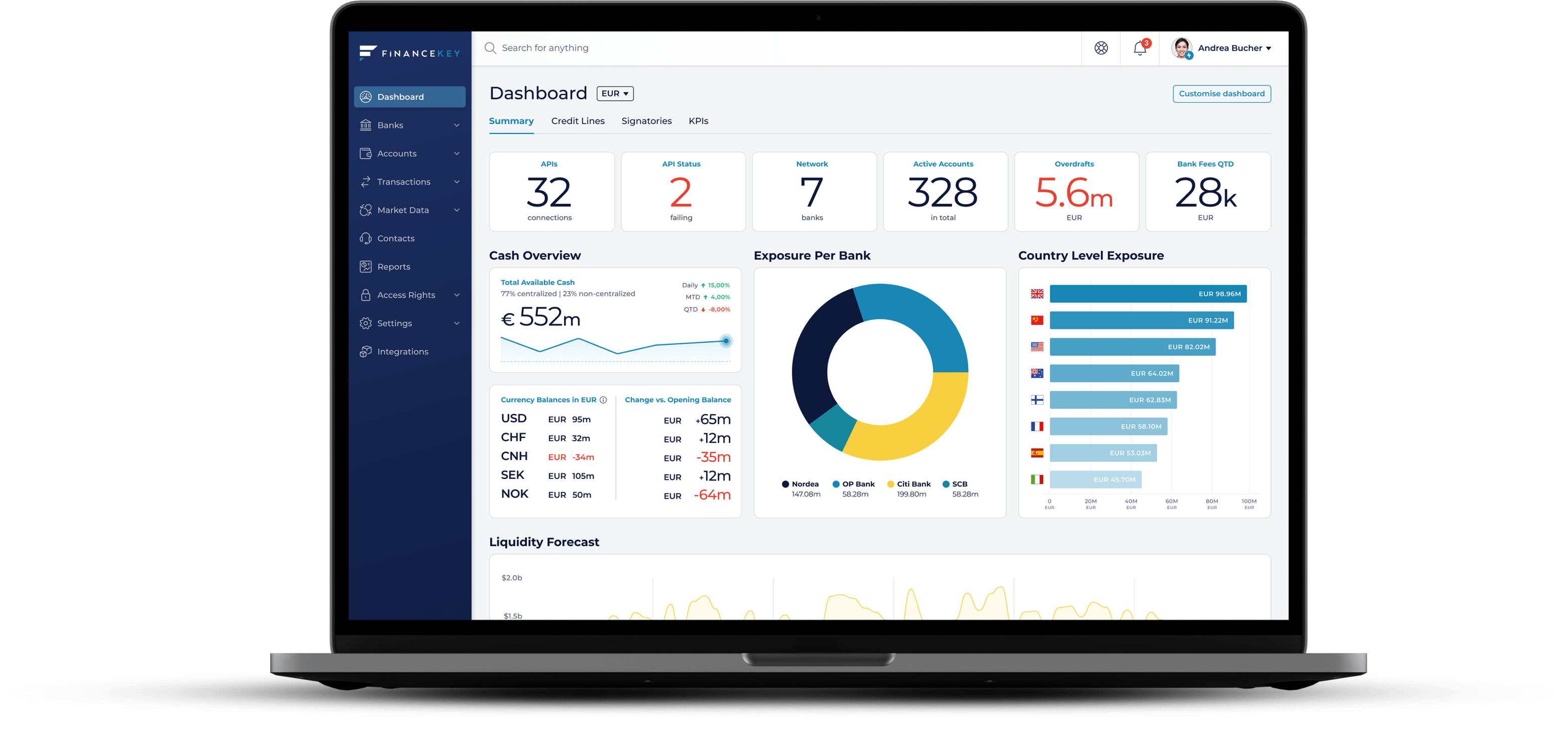

Get a real-time view of your bank account balances in one place instantly.

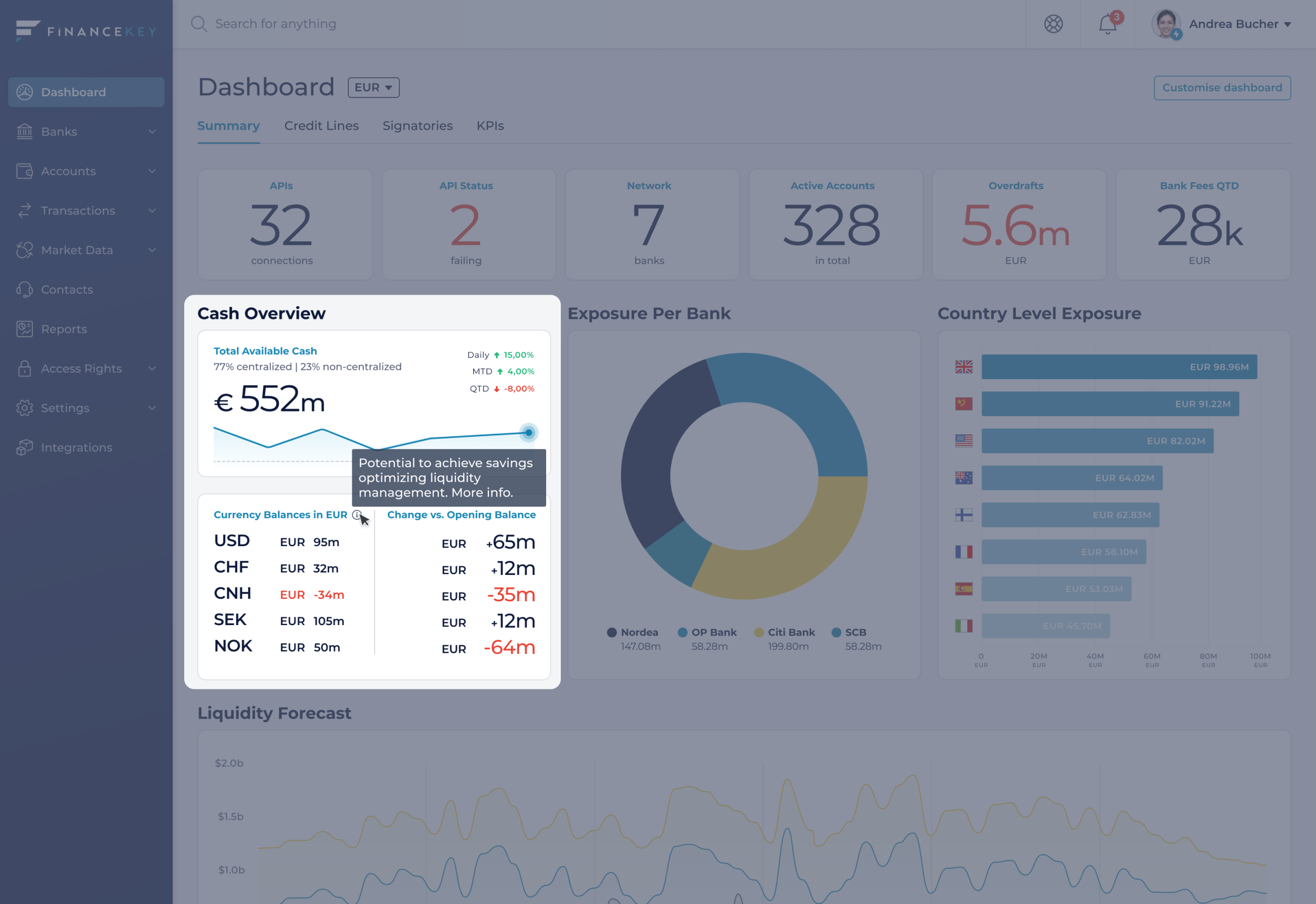

On top of that, FinanceKey helps you automate liquidity management of multiple banks' cash pools in one source.

You can easily integrate payment data from existing systems to FinanceKey, to get the required forecast for currencies with T+1 and T+2 settlements.

Transfer all liquidity related FX dealing needs to multi banking platforms as a mass action, or for selected cash pools only.

Choose FX API to deal directly with your cash management bank for more favourable cut-off times, potentially saving costs by achieving better rate without the fees embedded to multibanking platform pricing.

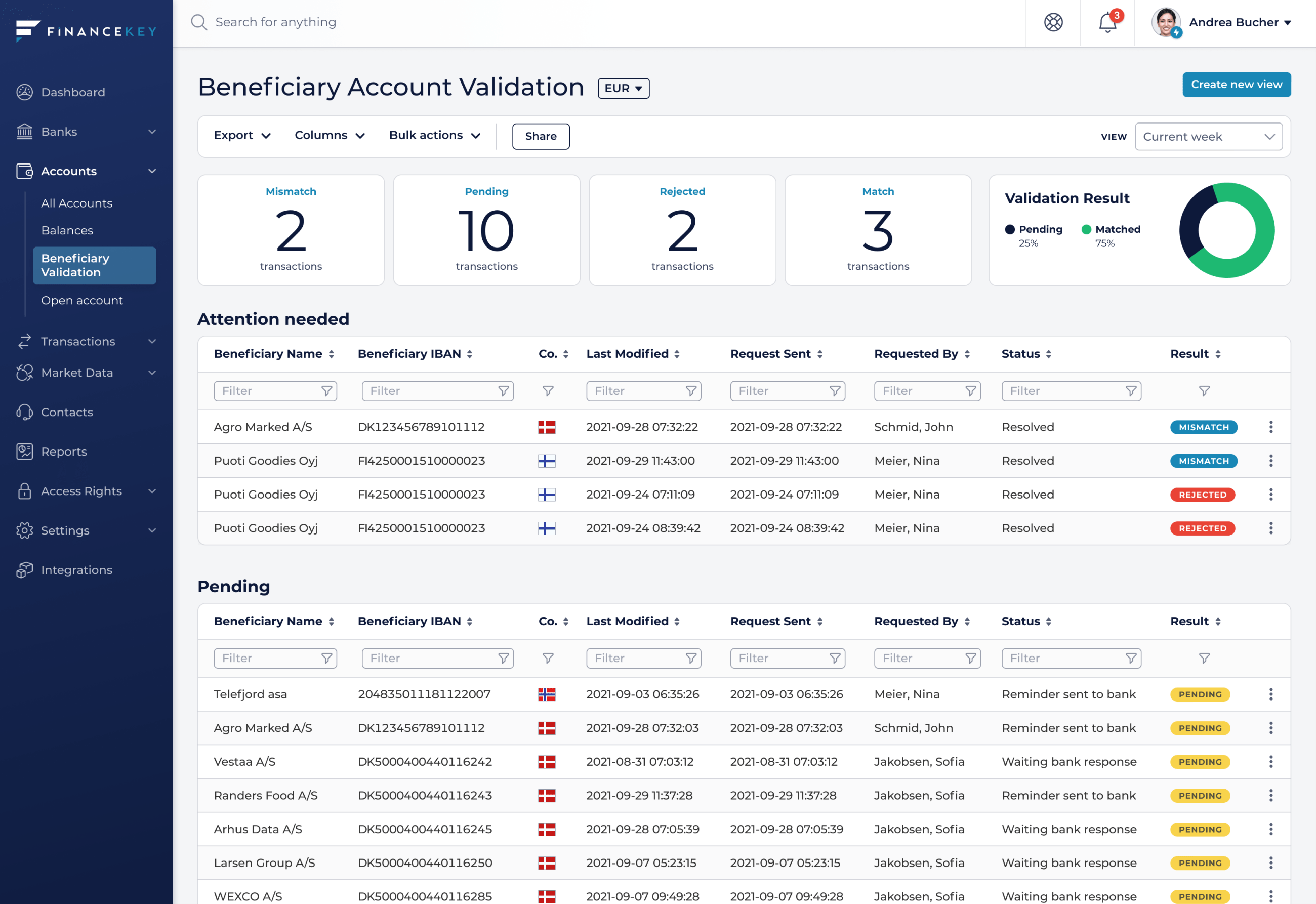

Ensure your payments arrive at the intended beneficiary.

Save money and time avoiding fraud and automating a manual process of checking the beneficiary details when account information gets changed or adding a new vendor to your existing vendor management system.

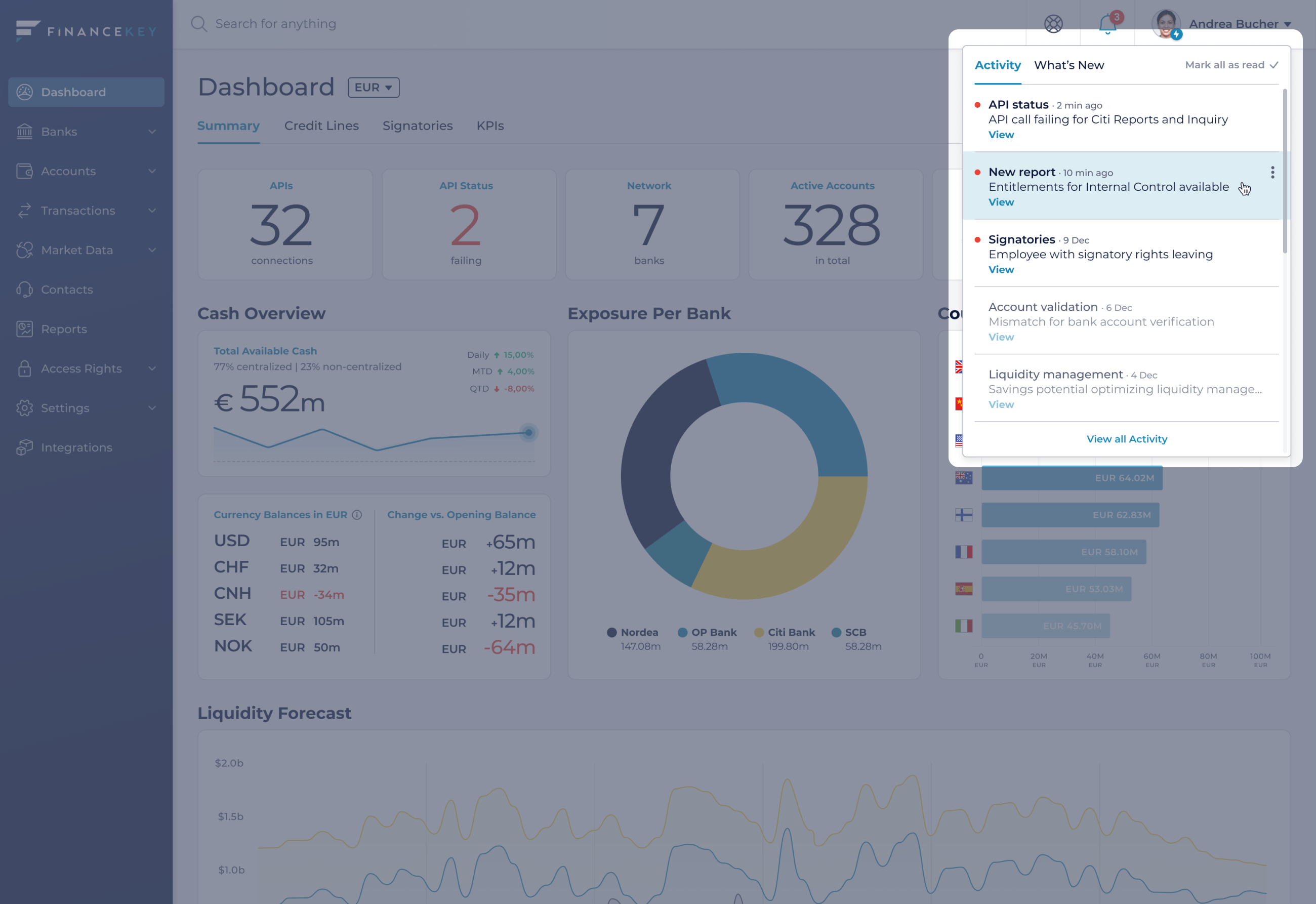

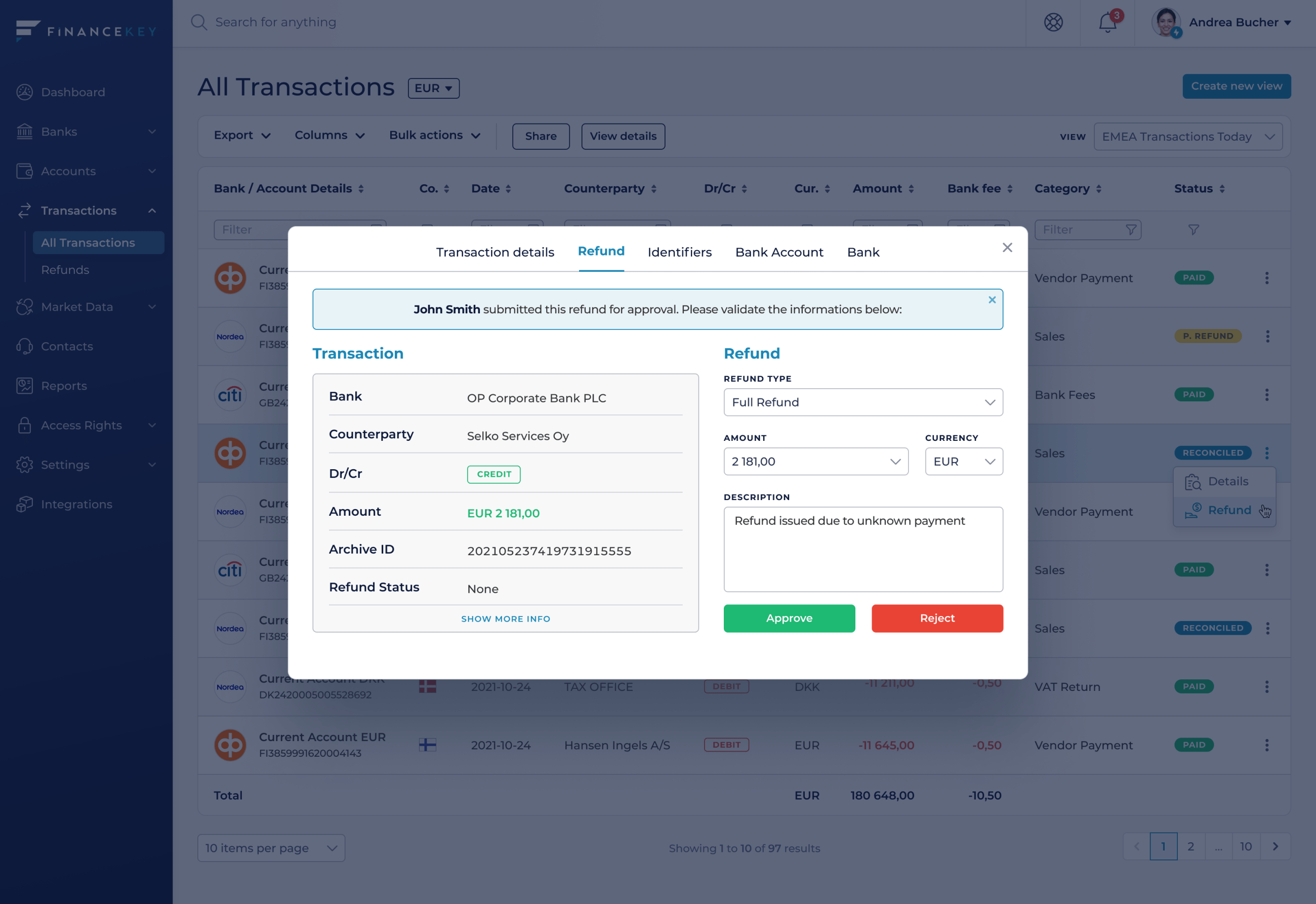

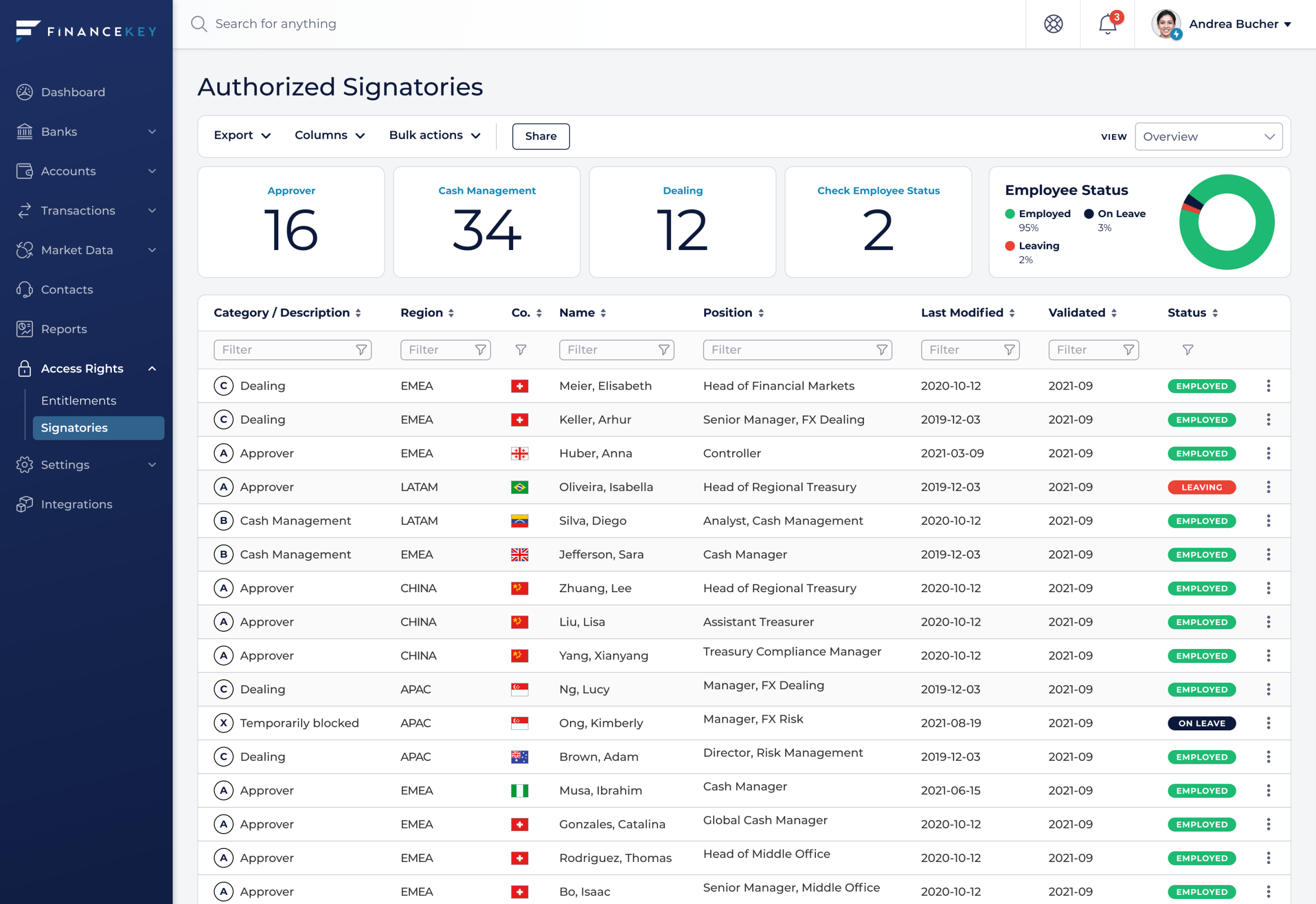

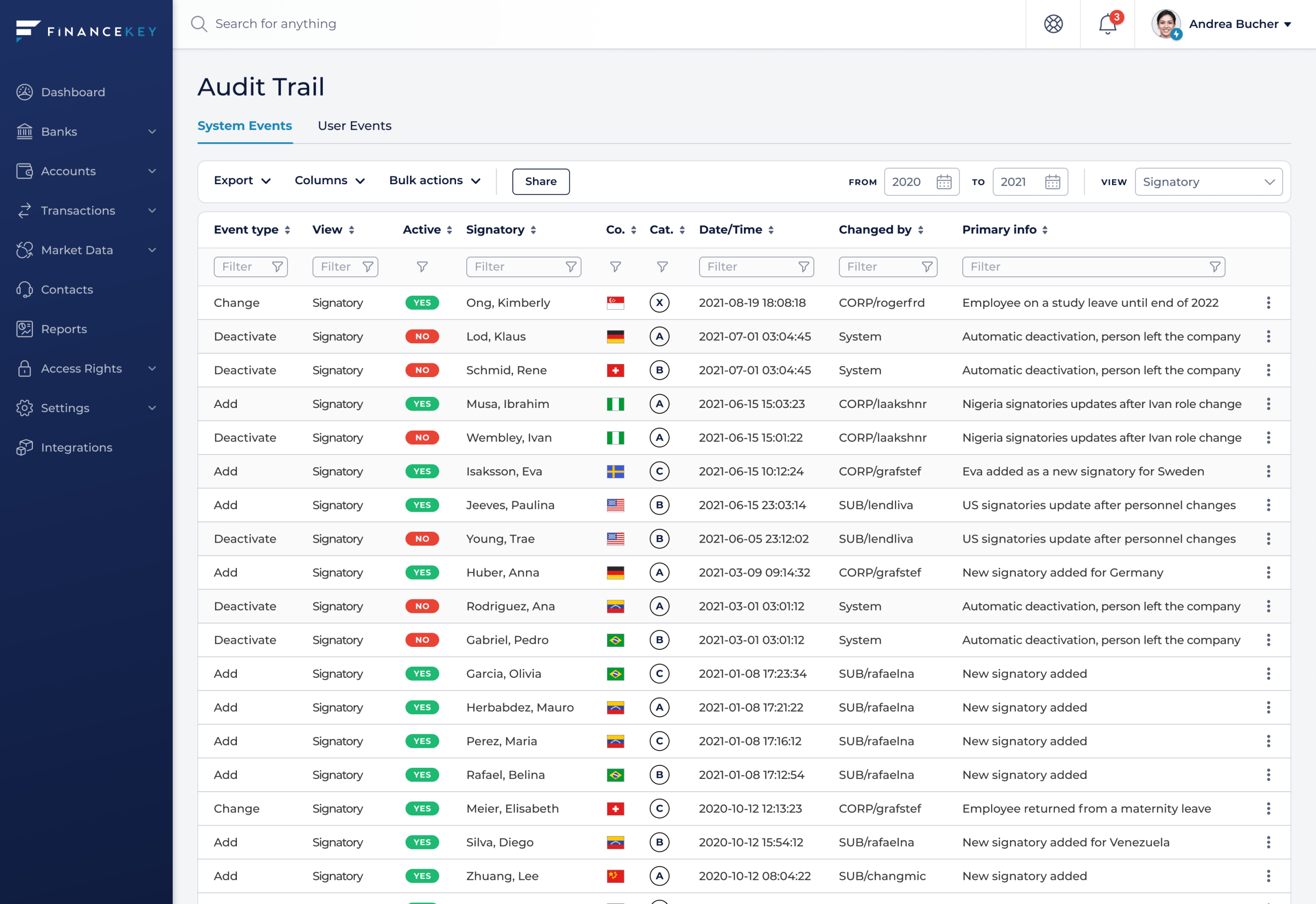

We log all system and user-related actions into the audit trail. All the steps in transactions get recorded.

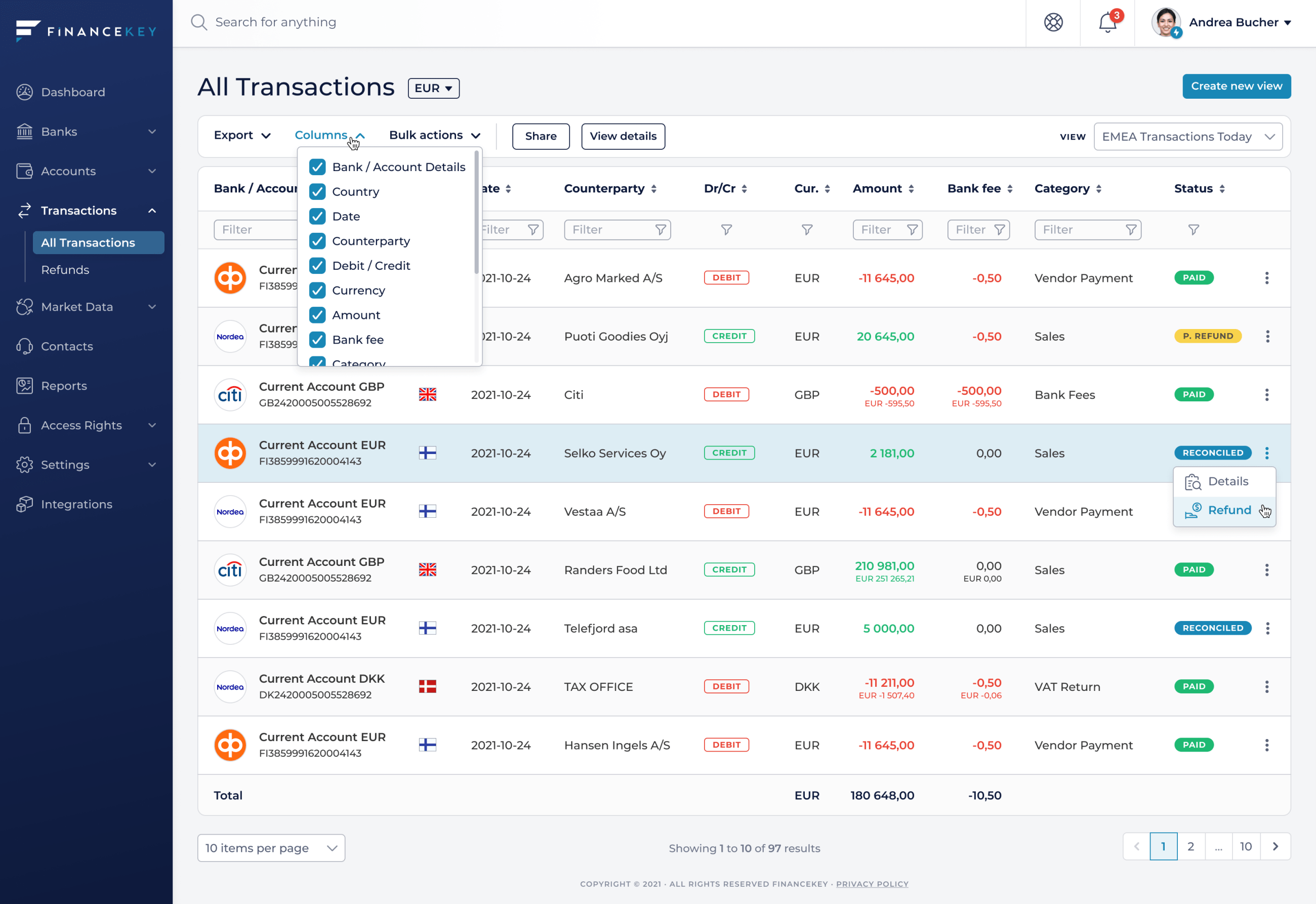

You can create views to fulfill the control needs of various parties and schedule automatic reports sent to responsible contacts. Rest assured, compliance needs are covered.

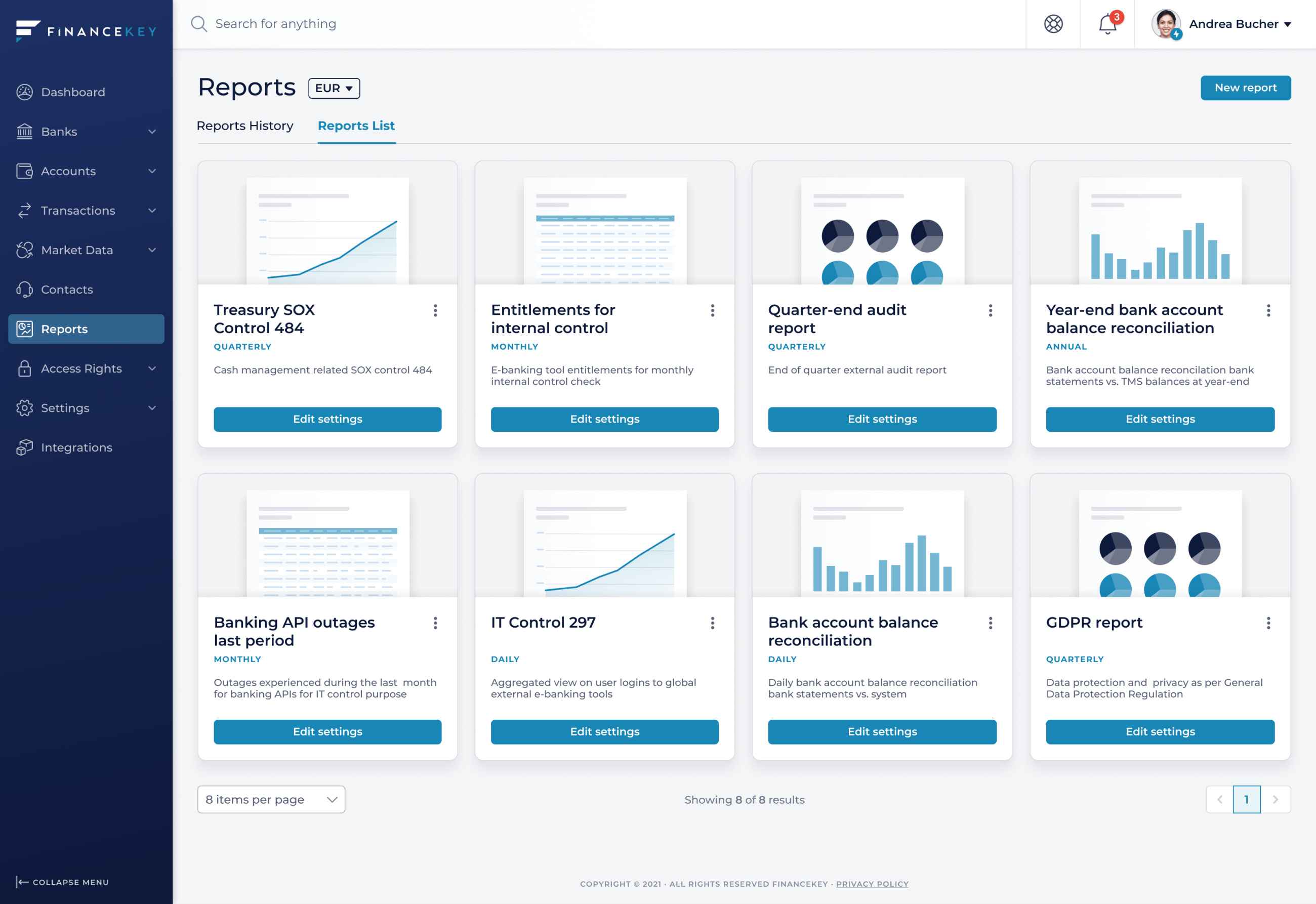

Schedule automated reports on your banking data and services for an internal and external audit, internal controls, and IT managers.

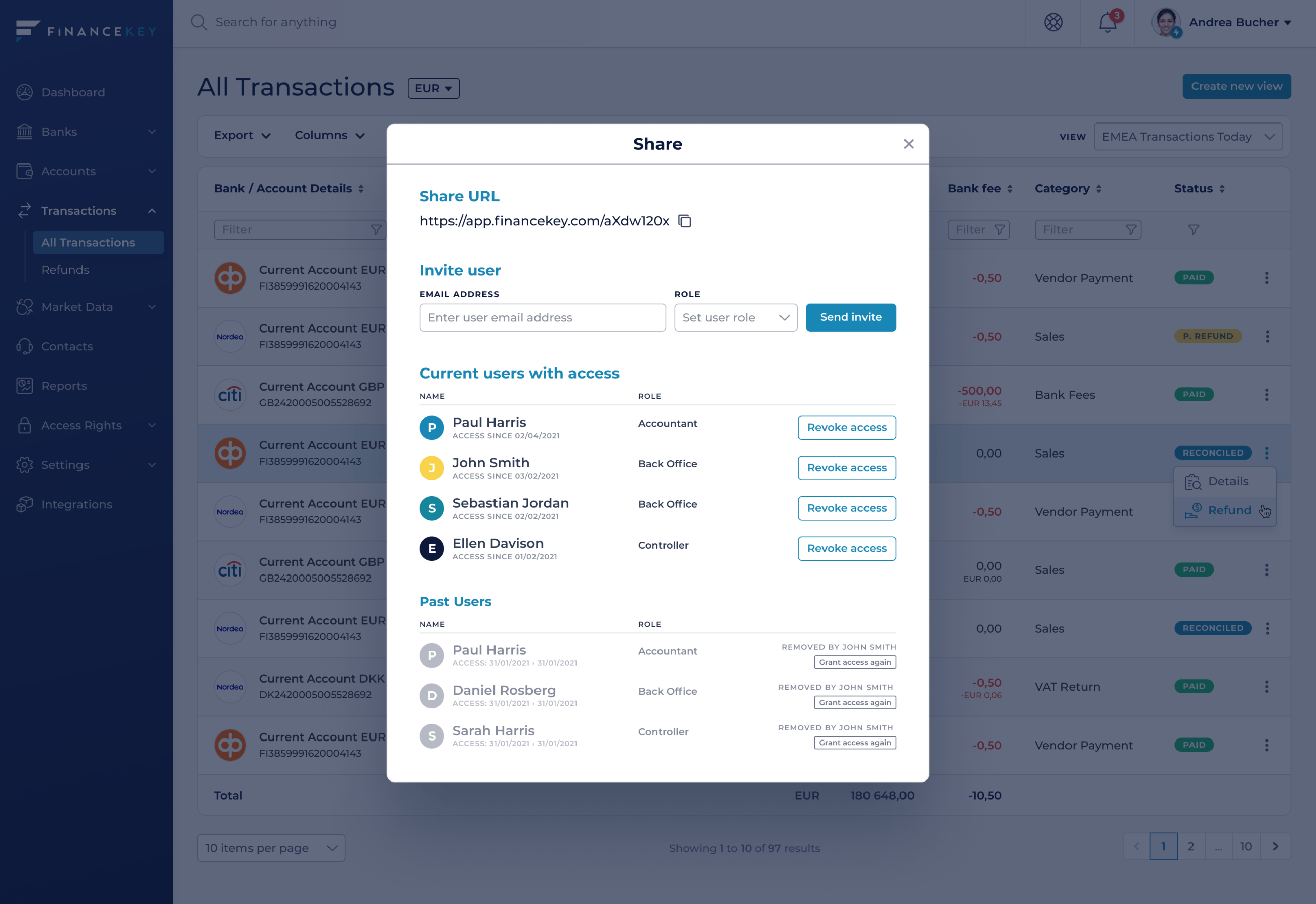

Simplify your life even more by sharing access to the needed reports or adding externals as recipients.

Later, you'll be able to expose selected data and reports via APIs to third parties and external stakeholders, like auditors.

That's FinanceKey.

What are your thoughts?

We are building a modern, integrated corporate banking experience — a product designed for finance employees bringing actual value to business.

What else would you like us to work on to ease your daily work? Any other questions you have for us?

Please reach out to us, share your questions and thoughts: hello@financekey.com